Why Running Behind high return mutual fund might not be the right strategy!

Investors are often tempted to invest in high return mutual funds just in the past….

SWP Calculator SWP Calculator Corpus Left Required SWP Initial Corpus (₹) – Amount you start with Return Rate (%) – Expected annualized returns Return Frequency – How often the return is applied YearlyMonthlyWeekly Time Period (Years) – How long the SWP will run SWP Amount – Amount you withdraw periodically SWP Frequency – Weekly, Monthly…

SIP & Corpus Calculator SIP Calculator Corpus Calculator Final amount you want to accumulate Annual rate of return expected Total time in years How often will you invest? MonthlyWeeklyYearly Calculate SIP Download SIP Excel Amount you will invest regularly Annual rate of return expected Total time in years How often will you invest? MonthlyWeeklyYearly Calculate…

Sectoral investment is catching up these days among youths who like to keep a tab on what is happening in the market. These are usually for short to medium term horizon. These sector selection can be based on Seasonality, macro change, charts & P/E ratio. In this we are going to use charts and P/E…

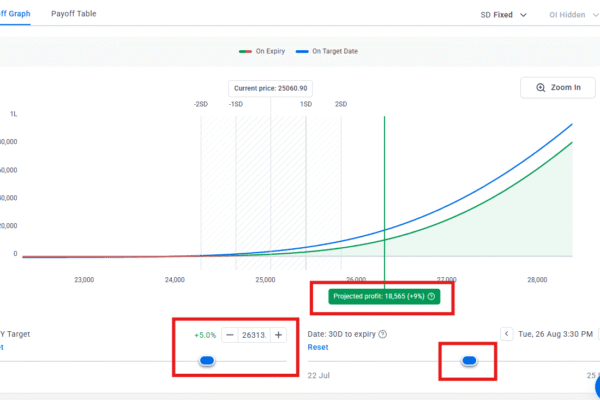

This Options Strategy is a combination of Nifty futures and options. Lets get into the components of it along with a graph. This is a no Adjustment options strategy – deploy and forget. There are more avenues to increase the profit as well. Note: This Strategy is not free. If you are interested in knowing…

Investors are often tempted to invest in high return mutual funds just in the past. However, chasing high CAGR Mutual Fund (Compound Annual Growth Rate) may not always be the right strategy. Past performance is not a reliable predictor of future success. Mutual funds that have delivered stellar returns in specific market cycles often underperform…

In a fast-evolving financial landscape, many investors are increasingly adopting a 3-year investment horizon and labeling it as “long term investments” While traditionally long-term investing implied a period of 5 to 10 years or more, market dynamics, technological disruption, and investor behavior have shortened perceived timelines. But is this redefinition justified? Let’s examine this through…

In the Indian context, long term investments are far from a myth — but it depends heavily on the asset, timing, and location. Over the last few decades, equities have consistently outperformed other investment classes. The Sensex has delivered ~15–16% CAGR since the 1980s, turning ₹1 lakh into crores, even after accounting for inflation. While…

If the Iran Israel war escalates, the global fallout could be both immediate and far-reaching, with strong implications for geopolitics, global trade, and market dynamics—particularly in oil-import dependent countries like India. 1. Huge Risk of Escalation if Iran Continues Escalation The biggest fear lies in Iran’s retaliation, which could turn a bilateral conflict into a…

Given India’s determination to be the powerhouse of semiconductor manufacturing not only to meet it own needs but also emerge as one of the largest exporter in a decade time, lets explore some of the top semiconductor stocks of india which will create your fortune. 1. Tata Elxsi – Semiconductor Design & Verification Tata Elxsi…

When the Reserve Bank of India (RBI) reduces the repo rate, it lowers the cost at which banks borrow money from the central bank. This has an immediate macro-level impact on liquidity and interest rates across the economy. Banks, in response, reduce lending rates on loans, making credit cheaper for businesses and consumers. This is…